Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s largest semiconductor manufacturer, is set to make a groundbreaking $165 billion investment in the United States. This latest move, which includes a newly announced $100 billion expansion, builds on the company’s previous $65 billion commitment to boost domestic chip production. The investment aims to enhance America’s self-sufficiency in semiconductor manufacturing and reduce reliance on overseas supply chains.

TSMC’s U.S. Expansion: A Strategic Move for Economic Security

TSMC, a key supplier for tech giants like Apple, Intel, and Nvidia, has already begun construction on multiple semiconductor fabrication plants in Arizona. The first of these facilities has successfully commenced mass production of advanced 4-nanometer chips. With the latest investment, TSMC plans to establish three additional chip manufacturing plants and two state-of-the-art packaging facilities in the region.

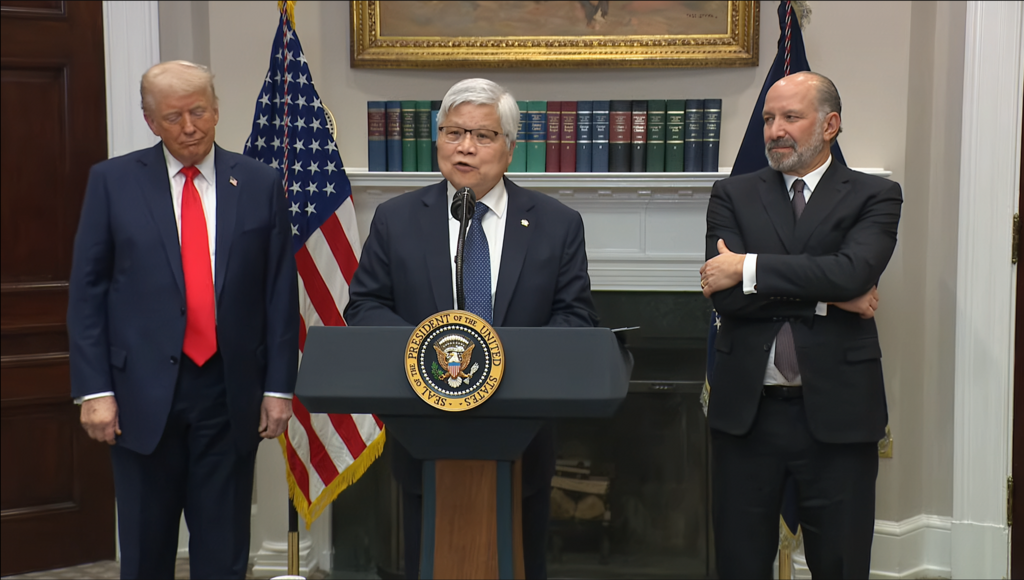

Speaking at the White House alongside TSMC CEO C.C. Wei, President Donald Trump hailed the investment as a major milestone for America’s economic and technological security.

“Semiconductors are the backbone of the 21st-century economy. Without them, industries from AI to automobiles and advanced manufacturing would collapse. We must ensure that we can produce the semiconductors we need right here in the United States, using American skills and labor,” Trump emphasized.

Impact of TSMC’s $165 Billion U.S. Investment

The newly expanded investment is projected to generate thousands of high-paying jobs, fostering economic growth and positioning the U.S. as a global leader in semiconductor production. C.C. Wei underscored the significance of this initiative, noting that it aligns with the company’s long-term vision for innovation and supply chain resilience.

“Our commitment to the United States underscores the importance of strengthening semiconductor supply chains and ensuring advanced chip manufacturing remains robust. These new facilities will bring cutting-edge technology, innovation, and job creation to the U.S.,” Wei stated.

The CHIPS Act and Its Role in Reviving U.S. Semiconductor Manufacturing

The U.S. government has been actively working to bolster domestic semiconductor production. In 2022, former President Joe Biden signed the CHIPS and Science Act, a $280 billion initiative aimed at revitalizing the American semiconductor industry. The COVID-19 pandemic had exposed vulnerabilities in the global chip supply chain, causing production halts and widespread disruptions across multiple industries, from consumer electronics to automotive manufacturing.

While the CHIPS Act provides federal subsidies and incentives to semiconductor firms investing in U.S. manufacturing, Trump has taken a different stance. He has proposed imposing high tariffs on imported chips as a means to encourage domestic production. Trump has also argued that companies like TSMC do not need additional federal tax incentives, asserting that market conditions alone should drive investment decisions.

Geopolitical Implications: U.S.-Taiwan-China Relations

Amid escalating tensions between Taiwan and China, the strategic significance of TSMC’s U.S. expansion cannot be overstated. When asked about whether the investment could mitigate the risks of a potential Chinese blockade or takeover of Taiwan, Trump acknowledged the complexities involved.

“I wouldn’t say ‘minimize’ because that would be a catastrophic event. However, this investment ensures that the U.S. will have a significant portion of semiconductor production within its own borders,” he explained.

Taiwan, which has maintained de facto independence from China since 1949, faces continued political and military pressure from Beijing. The Taipei Economic and Cultural Representative Office (TECRO), Taiwan’s unofficial embassy in the U.S., welcomed TSMC’s investment, emphasizing the deepening economic and trade ties between the two nations.

“Taiwanese businesses have invested over 40% of their total foreign investments in the United States. This expansion not only strengthens U.S.-Taiwan economic relations but also ensures supply chain security and stability,” a TECRO representative said.

Will U.S. Chip Production Drive Up Prices?

The expansion of semiconductor manufacturing in the U.S. could lead to higher chip prices in the short to medium term due to several factors:

- Higher Manufacturing Costs in the U.S.

- U.S. wages and benefits are significantly higher than in Taiwan or China.

- Environmental and workplace regulations increase compliance costs.

- Land, utilities, and construction expenses are higher in the U.S.

- Reduced Reliance on Cheap Imports

- Tariffs on imported chips may shift production to domestic plants, increasing costs.

- Government Subsidies vs. Market Prices

- The CHIPS Act provides financial support, but it may not fully offset the higher production costs.

- Supply Chain Reshuffling

- Restructuring logistics and securing raw materials may add to overall costs.

Short-Term vs. Long-Term Price Impact

- Short-Term (Next 5 Years): Chip prices are likely to increase due to high capital investment and initial production costs.

- Long-Term (Beyond 5-10 Years): Once domestic production scales up and supply chains stabilize, prices could decrease due to competition and economies of scale.

How This Affects Consumers

Higher production costs will likely lead to more expensive chips, impacting industries such as:

- Consumer Electronics – Smartphones, laptops, and gaming consoles could see price hikes.

- Automotive Industry – Increased chip costs may lead to more expensive vehicles.

- AI and Data Centers – High-performance computing may become pricier due to premium semiconductor costs.

Despite potential short-term price increases, increased domestic production will strengthen supply chain resilience, reduce dependency on foreign manufacturers, and enhance the U.S.’s competitive edge in the semiconductor sector.

U.S. Business Landscape: A Surge in High-Value Investments

Since taking office in January, Trump has actively engaged with business leaders to promote major investments in the U.S. economy. In addition to TSMC’s historic commitment, he has facilitated discussions with OpenAI, Oracle, and SoftBank, leading to a $500 billion AI infrastructure investment partnership. Similarly, Apple recently announced a $500 billion investment in U.S. manufacturing, including the construction of a new server factory in Texas.

Trump has attributed these investments to his administration’s economic policies, particularly the use of tariff threats as a negotiating tool.

“It’s the incentive we’ve created—or the negative incentive,” Trump remarked, referencing his administration’s aggressive stance on trade policy.

The Future of U.S. Semiconductor Manufacturing

TSMC’s historic $165 billion investment marks a transformative moment for the U.S. semiconductor industry. By expanding advanced chip production in Arizona, the company is not only securing its own future but also strengthening America’s technological resilience. With increasing geopolitical tensions and a heightened focus on supply chain security, the move underscores the importance of fostering a self-reliant and globally competitive semiconductor sector in the United States.

As the semiconductor landscape continues to evolve, this investment positions the U.S. at the forefront of the global chip race, ensuring economic stability and innovation leadership for years to come.